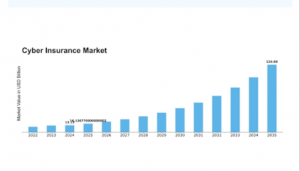

Cyber Insurance Market to Expand at 22.9% CAGR | Global Market to Reach USD 126.89 Billion by 2035

Cyber Insurance Market By Coverage Type, Deployment Mode, Application, Organization Size, Regional

NEW YORK, CA, UNITED STATES, December 9, 2025 /EINPresswire.com/ -- The global Cyber Insurance market has witnessed significant growth in recent years and is poised for accelerated expansion in the coming decade. In 2024, the market size was valued at USD 13.13 billion and is projected to grow from USD 16.14 billion in 2025 to an impressive USD 126.89 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 22.9% during the forecast period (2025–2035).The growth is primarily driven by rising cyber threats, increasing digitalization across industries, and heightened awareness of risk management and regulatory compliance.

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

• Escalating Cybersecurity Threats

The surge in cyberattacks, data breaches, and ransomware incidents has amplified the need for robust cyber insurance policies to mitigate financial and reputational losses.

• Regulatory Compliance

Governments and regulatory bodies worldwide are mandating stricter data protection and cybersecurity measures. Organizations are increasingly investing in cyber insurance to ensure compliance and safeguard against penalties.

• Growing Digital Transformation

Rapid adoption of cloud computing, IoT, and AI technologies across enterprises increases vulnerability to cyber threats, further driving demand for cyber insurance coverage.

• Risk Management and Business Continuity

Companies are prioritizing cyber insurance as a key component of risk management strategies to ensure operational continuity and financial protection in the event of cyber incidents.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 : https://www.marketresearchfuture.com/sample_request/8635

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐲𝐛𝐞𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐜𝐥𝐮𝐝𝐞

• AIG (American International Group)

• Chubb Limited

• Zurich Insurance Group

• Allianz SE

• AXA XL

• Beazley PLC

• Munich Re

• CNA Financial Corporation

• Hartford Financial Services

• Tokio Marine Holdings

• Berkshire Hathaway Specialty Insurance

• Hiscox Ltd

• Liberty Mutual

• Lloyd’s of London

• Travelers Insurance, among others

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 (𝟏𝟏𝟎+ 𝐏𝐚𝐠𝐞𝐬) 𝐨𝐧 𝐂𝐲𝐛𝐞𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.marketresearchfuture.com/reports/cyber-insurance-market-8635

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

To provide a comprehensive analysis, the cyber insurance market is segmented based on coverage type, organization size, industry vertical, and region.

1. By Coverage Type

• Data Breach Insurance

• Network Security Insurance

• Business Interruption Insurance

• Cyber Extortion Insurance

• Errors & Omissions

2. By Organization Size

• Small & Medium Enterprises (SMEs)

• Large Enterprises

3. By Industry Vertical

• Banking, Financial Services, & Insurance (BFSI)

• Healthcare & Life Sciences

• IT & Telecom

• Retail & E-commerce

• Government & Public Sector

• Manufacturing

• Energy & Utilities

4. By Region

• North America: Leading market due to high cyber risk awareness and advanced insurance infrastructure.

• Europe: Growth driven by GDPR compliance and robust cybersecurity frameworks.

• Asia-Pacific: Fastest-growing region, fueled by digital transformation and increasing cyber threats in emerging economies.

• Rest of the World: Steady growth across Latin America, the Middle East, and Africa.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8635

The global Cyber Insurance market is poised for rapid growth, driven by escalating cyber risks, technological adoption, and regulatory mandates. As businesses and governments prioritize digital risk management, the demand for comprehensive cyber insurance solutions will continue to rise, shaping the future of the global insurance industry.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

Biometric Banking Market-https://www.marketresearchfuture.com/reports/biometric-banking-market-11821

Investment Banking Market-https://www.marketresearchfuture.com/reports/investment-banking-market-11815

Neobanking Market-https://www.marketresearchfuture.com/reports/neobanking-market-12100

Brazil Retail Banking Market-https://www.marketresearchfuture.com/reports/brazil-retail-banking-market-21418

Banking and Finance Sector Market-https://www.marketresearchfuture.com/reports/banking-finance-sector-market-21861

Decentralized Finance Market-https://www.marketresearchfuture.com/reports/decentralized-finance-market-11510

Applied AI in Finance Market-https://www.marketresearchfuture.com/reports/applied-ai-in-finance-market-12177

Financial App Market-https://www.marketresearchfuture.com/reports/financial-app-market-5649

Digital Identity in BFSI Market-https://www.marketresearchfuture.com/reports/digital-identity-in-bfsi-market-12144

Generative AI in BFSI Market-https://www.marketresearchfuture.com/reports/generative-ai-in-bfsi-market-12182

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.